If you are thinking about listing your home for sale, but you are not quite sure if the timing is right, then you have come to the right place. There are a number of factors that influence the real estate market, and therefore, should also influence your home-selling decisions. For example, 2021 and 2022 were marked by unprecedented buyer demand, low inventory, and price growth. Most homeowners were able to sell their property for much more than what they paid, and quickly at that.

However, as we navigate the market in 2023, it is clear that the advantages are no longer skewed toward sellers. That does not mean it is a bad time to sell, though. Asking the right questions will help you decipher the pros and cons of your local market, and whether it is an opportunistic time to sell your house. This article will go over seven of the most important questions to ask, and how they might affect your next steps.

7 Questions to Ask Before Selling Your Home

Here are 7 questions you should be asking before putting your home on the market:

1. What is the market value of my house?

Step one of selling real estate is to establish a pricing strategy. Knowing the true market value of your house will help you price it according to your goals. For example, if you list your home way over market value, it may not attract as many buyers. This means it will likely sit on the market for a much longer amount of time before you receive an acceptable offer. If your goal is to sell quickly, this would not be a smart pricing strategy. Your real estate agent will use the data from recent home sales nearby to help you determine market value.

2. Are home prices rising or falling?

Next, it is important to know whether home prices are trending upward or downward. If prices are falling, then you may decide to list your house as soon as possible to get the most value. Remember that real estate values fluctuate regularly, but the majority of homes will go up in value over the long-term. If you discover that your local market is in a recession, it may be better to wait a few more years until prices are rising again.

Also, when analyzing price growth, be sure to ask for a comparison on a year-over-year basis in addition to month-over-month. For example, the S&P Dow Jones Indices show that US home price gains steadily declined from September 2022 to October 2022; however, price gains were still 9.2% higher than they were in October 2021. This reveals that homes are still rising in value, though at a slower pace.

3. Is the market favoring buyers or sellers?

Knowing where you stand in terms of market advantages will help you know what to expect from buyers. If your local market is favoring buyers, they will likely have the upper hand in negotiations. This means that your offers may fall below asking price or come with several contingencies. On the other hand, if sellers have the advantage, or if the market is balanced, you may be able to negotiate for yourself more aggressively without losing the deal.

4. Are there other houses for sale in my neighborhood?

Before you put your house on the market, you need to know if it has competition. Ask your agent if there are other houses for sale nearby, and if so, find out their size, features, condition, and price. If your home’s biggest selling points are available down the street for a lower price, you will be at a disadvantage. Figure out what makes your house unique, then work with your agent to craft a marketing strategy that highlights those benefits.

5. How do I prepare my house for the market?

When your house is on the market, it will undergo a lot of scrutiny. After all, buyers want to be sure they are making a smart investment. From the listing photos to showings and inspections, your house should look its best. Therefore, you should ask your agent what prep work your house needs in order to sell for the most money. Be sure to read our last blog post, “5 steps for prepping your home to sell” for more tips.

6. How can I incentivize potential buyers?

In the case that buyer demand is low in your local market, you may need a plan to incentive buyers. For example, since mortgage rates are much higher than they were the past two years, some buyers may have trouble affording the monthly payments at the price you are asking. As a result, more sellers are offering to buy down buyers’ interest rate as an incentive. Other common incentives for buyers include paying closing costs, buying a home warranty, or offering to do repairs on the house.

7. What will my bottom line be?

The final question, and arguably the most important, pertains to your bottom line, or the cash you will walk away with from the sale. Keep in mind, the purchase price is often not the bottom line, since you will typically owe closing costs, and you may also have to pay off a mortgage or other liens. Ask your agent to run the numbers for a few different pricing scenarios, so that you can be confident that the sale of your house is beneficial to your financial goals.

Ready for Answers?

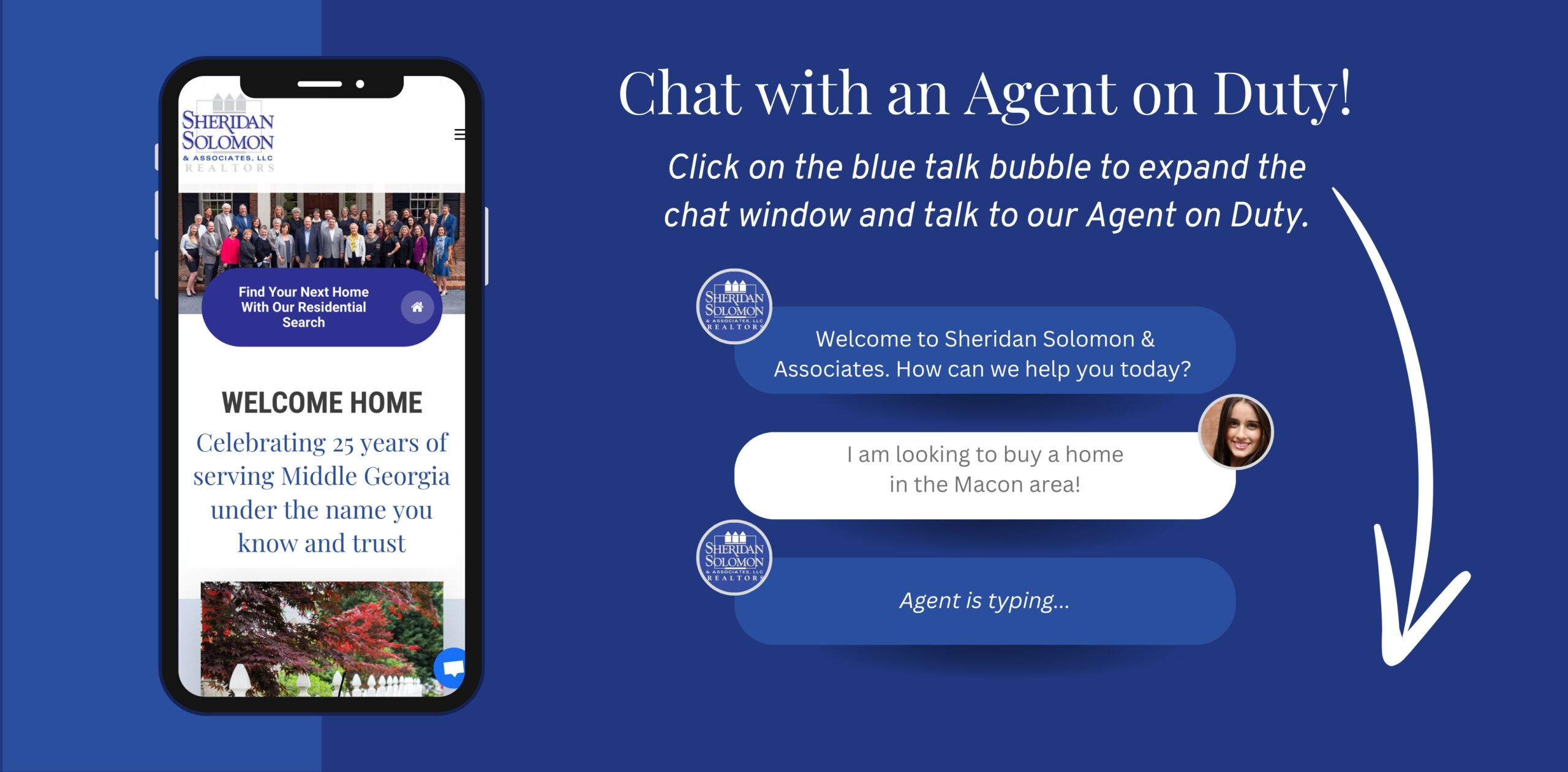

Now that you know all the right questions to ask, your next step is to connect with an experienced real estate agent in your area. Our team of agents at Sheridan Solomon and Associates are all experienced professionals with extensive knowledge of Macon and the surrounding areas. Once you find an agent to work with, they will take all the guesswork out of the equation by guiding you in the sale of your home from start to finish.

If you are ready to learn more, please give us a call at (478) 746-2000, or reach out on our website, www.sheridansolomon.com.