Are you thinking about buying a house? Before you do so, it may be a good idea to do a bit of timely research. Checking out the conditions for home sales in your local housing market is a smart move. And as it turns out, the time may be right for you to make your move, and Sheridan Solomon & Associates in Macon GA and Warner Robins GA are here to help. Our real estate agents are ready to answer any of your questions.

Is Now a Good Time to Buy a House?

The question on everyone’s mind is naturally going to be, “Is now a good time to buy a house?” So far, all of the signs are trending in a positive direction. Heading into 2020, the housing market is flush with current and pending sales. The fact that home sales are up while mortgage rates are down is a very significant factor.

Indeed, now that mortgage rates are at historic lows, more and more people are seizing on the newly afforded chance to buy a home. They are even considering properties that, up until this moment, have been somewhat beyond the reach of their budget. As a result, some properties that have had less appeal are now getting a second chance.

This unprecedented level of savings on mortgage rates is guaranteed to heat up a fall and winter housing season that is usually quite tepid. As a result, builders will find themselves working a bit of overtime to catch up to this unexpected rise in demand. This, in itself, is a development that will fuel a new level of industry profitability.

Pending Sales and New Contract Activity Are On the Rise

It’s interesting to note these fascinating new changes in the housing market. Pending home sales, as well as new contract activity, are both on the rise. These pending sales have traditionally been an accurate measure of real estate contracts that have been signed but have yet to be closed.

As of August 2019, these pending sales hit a significant level of rebound after suffering through an unpleasant slump in the previous month. Reports from industry sources were quick to point out that this downturn may only have been a preliminary response to a major upswing. As it turns out, these predictions were to be proven correct.

Not only are pending sales on the rise, but contract activity is also up. It has managed to rise 1.6 percent month over month since August to a level of 107.3. Keep in mind that a level of 100 is considered to be the norm. Sales have also sustained a 2.5 percent rise that shows no signs of abating soon.

It should also be pointed out that the 30 year fixed mortgage rate recently hit 3.64 percent. This is a full percent down from last year’s average of 4.72 percent. Meanwhile, pending sales are on the rise in all four of the major regions of the United States. The biggest gain, 8 percent year over year, is happening in the West.

Buyers Are Responding to Historically Low-Interest Rates

One of the most positive and exciting developments of the past several months is the fact that new home buyers have been able to take advantage of historically low-interest rates. As a result, the demand for homes, both existing and in development, is higher than ever, leaving builders to play catch up with increasing demand.

A series of relative slumps that were threatening to derail this momentum appear to have been checked. This is especially true in the West, an area which, as noted above, has managed to rebound spectacularly. The trend seems to be that a newly observed rise in demand will drive up home price appreciation due to the lack of supply.

Mortgage rates, as always, are subject to both minor and major fluctuations. However, on the whole, they have actually been decreasing at a steady pace. They were fixed at 4.51 percent in January but have dropped since then. This is partly due to a series of two separate rate cuts that were approved by the Fed.

Indeed, mortgage rates are not always in lockstep with the Fed. In general, however, changes in short term mortgage rates do tend to put palpable pressure on long term rates. This is especially true in the case of the ten year Treasury note and its series of intimately related mortgage rates.

Get in Touch with Us Today for More Info

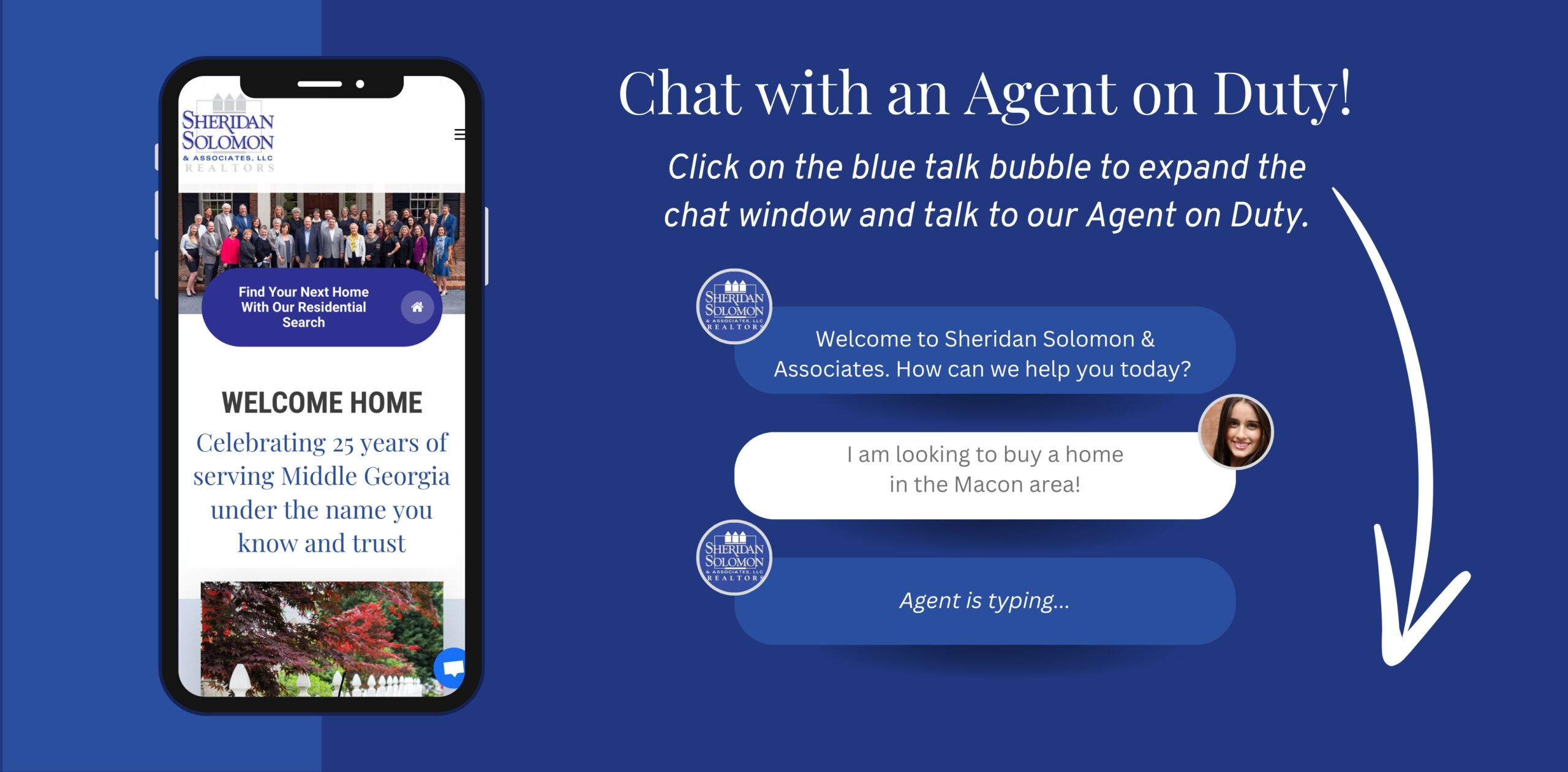

If you would like to learn more about the rise in property sales as well as the current decrease in mortgage rates, get in touch with Sheridan Solomon & Associates today. We’ll be happy to fill you in on the latest news concerning these exciting trends. Contact us directly or leave us a quick note to let us know what we can do for you.