Qualifying for a Home Loan

Buying a home can be one of the best investments you ever make. Instead of throwing your money away every month on a place that you will never own and can’t make changes to, it’s a better idea to put your money towards something that will one day be yours. Of course, buying a house isn’t cheap, so you’ll more than likely need to get a loan to achieve this goal.

What do I Need to Qualify?

When it comes to how to qualify for a home loan, one of the most important things you’ll need is a credit score. This will give lenders an idea of what your previous credit history is and whether or not you are going to pay back the loan. Some of the other things you’ll need to qualify for a home loan include:

Proof of Income

This can come in many forms, and lenders will often require seeing the past two years of your tax returns, as well as current pay stubs. They may also ask for any investment information you have, and you may be required to show them your statements. If you receive any benefits, including Social Security or disability, you’ll also have to show documentation of these as well.

Credit Check

When a buyer is trying to qualify for a home loan, financial institutions will conduct a credit check. Not only will this let them know what your score is, but it will give them an idea of what kinds of debts you have. This will help them determine how much money they are willing to provide you with to buy a home.

What Can I Do If My Credit Is Bad?

If your credit is less than spectacular, that doesn’t necessarily mean you won’t qualify for a home loan. Before you go in and apply, you might consider using one of the many free options to get an idea of what your score is. If you find that it needs some work, then improving credit is your best option.

If you aren’t desperate to move out of your current home and into a new one, then it’s in your best interest to dedicate time to improving credit. This will ensure that you get a home loan that has a great interest rate so that you can buy the house of your dreams.

If there isn’t time to improve your score before buying a home, then you might consider getting a cosigner. You’ll want to make sure you ask someone that has excellent credit to sign with you, as this can help you secure a loan that you can afford, as well as get you a better interest rate.

Types of Home Loans

There are many different types of home loans you can choose from when it comes to getting money to buy a house. Below are the home loans you might consider trying to qualify for.

FHA Loans

These are one of the most accessible home loans to get, and they are offered through the Federal Housing Administration (FHA). This loan could be a great option if you have bad credit. Since the FHA backs up to 90% of the mortgage, lenders are more comfortable offering this loan to borrowers who are considered risky.

Some of the requirements necessary to get this loan include a minimum of 3.5% for the down payment if you have a credit score of at least 580. If you have a credit score of between 500 and 579, then you will be required to put 10% down. The home must also be used as your primary residence, and you have to have proof of employment and a steady income for two years.

Conventional Loans

A conventional loan is a 15- or 30-year mortgage that has some slightly stricter qualifications than an FHA. Some of the requirements necessary for a conventional loan include having a credit score of 620 or higher, and you’ll need to show proof of steady income for the past two years. Depending on the lender, you may be able to put down as little as 3% on a conventional loan, but you will be required to get mortgage insurance.

VA Loan

If you are part of the military, including being active-duty, a reservist, veteran, or have a military member in your family, you might qualify for this loan. You will need to get a VA loan certificate of eligibility. There is no minimum credit score requirement, although some lenders have a cutoff of 620. You also don’t have to meet an income threshold or worry about having money for a down payment.

Buying a home is a significant long-term investment that allows you to get a place that you can truly call your own. Since a house can be expensive, you’ll probably need a loan. There are many options to choose from, and knowing which one is best for you will require talking to a professional. Give one a call today!

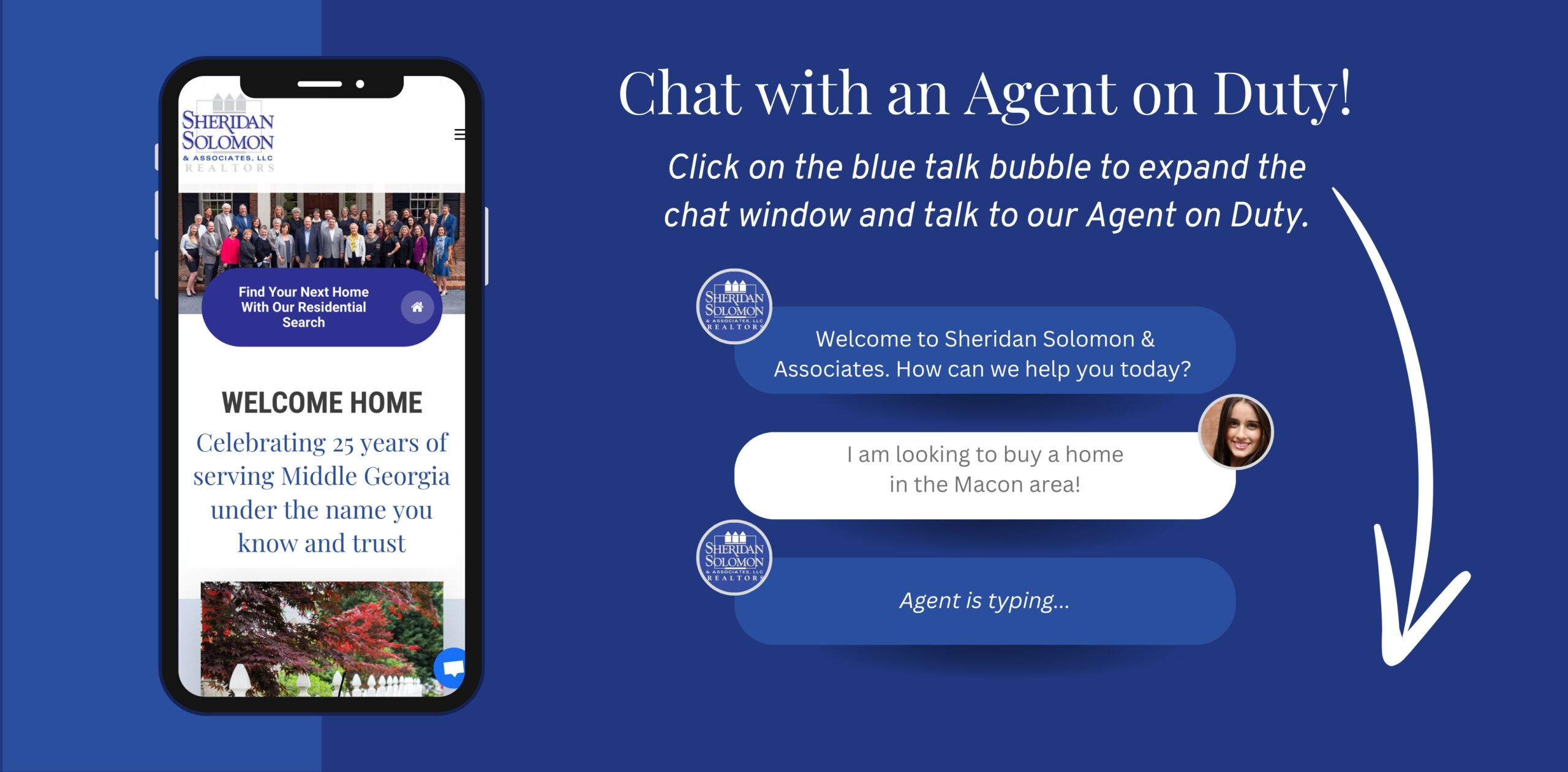

If you would like to learn more about home loans as well as the current mortgage rates, get in touch with Sheridan Solomon & Associates today. We’ll be happy to fill you in on the latest news concerning these exciting trends. Contact us directly or leave us a quick note to let us know what we can do for you.