When it comes to finding a comfortable place to live, many consider the benefits of renting as opposed to buying a home. In some parts of the country, there aren’t many rentals that work for up and coming families. However, in Macon, Georgia, there are lots of choices. The decision to rent or buy comes down to what your family needs at the time and your financial situation.

The Advantages of Renting

The benefits of renting as opposed to buying a home are vast. However, renting doesn’t work for everyone. Here is the main advantage of renting a home.

- Flexibility – Many people don’t know if they want to stay in an area long-term. If you’re not looking to put down roots, then renting is a good option. Leases come in month-to-month, six- and 12-month options. So if someone wants the flexibility to move, then renting is the best choice.

- Limited Resources – Buying a home requires a sizable down payment. Even on an FHA loan, you are required to have at least three percent down. If you don’t have the standard 20 percent for a down payment, then renting is the better choice.

- Maintenance – Renting is an excellent option for those who are not maintenance savvy. If your finances are limited, then renting means that the upkeep and repairs fall in the hands of the landlord.

Cons of Renting A Home

While there are some advantages to renting, there are also some cons to consider. For instance, you’re paying equity for someone else’s home. In most cases, the rent in Georgia is inflated far above the actual mortgage payment. You could spend $12,000 or more a year in rent, which could have easily gone towards paying off a home for retirement.

Plus, most landlords don’t allow you to customize a space to your liking. You can’t paint walls, remove carpeting, or make any alterations. You’re stuck with the designs of the home as it’s not yours to change.

The Advantages of Buying A Home

When you consider the benefits of buying as opposed to renting a home, you will see that there are many.

- You Can Customize – If you don’t like the shag carpeting from the 1970s, then you can replace it with hardwoods. When you own the home, you can do whatever you want to it.

- You Will Build Equity – If you need to update a bathroom, then it increases the equity in your space. Any repairs or updates you do make only increases the home’s value. Many repairs, like bathrooms or kitchens, can be recuperated 100 percent on the sale of the house. Plus, should you ever get in a pinch and need money, you can use the equity in your home to help.

- It’s a Major Tax Write Off – There are many things that you do for your home that are a tax write off. For instance, if you put in new windows or an energy-efficient heating and cooling system, then you can reap the rewards on your taxes.

- Payments Are Less Than Rent – In most cases, the mortgage payment with insurance is much lower than you would pay for market rent in the area. Why should you pay off someone else’s mortgage when your money can work for you?

- No Landlord Rules and Regulations – Landlords have a whole list of rules and regulations. They dictate whether you can have pets or if guests can stay longer than two weeks. When you own the property, you call the shots.

Cons of Owning A Home

The benefits of buying as opposed to renting a home are undeniable, but there are a few cons to owning too. First, if anything goes wrong inside the home, you are required to pay for it. You should have a nest egg to cover significant expenses. If you receive a job transfer or need to move for some other reason, it can be challenging to sell your abode. You may need to pay two mortgages for a while.

When you rent, property taxes and insurance are continually increasing. Your payment may also increase. Also, if you didn’t qualify for a fixed interest rate loan, your payment can continuously balloon over time. Speaking of insurance, should someone get hurt on your property, you are responsible for those injuries too.

Finding the Right Spot

You may wonder what market should I buy a home in vs. renting? From the North to the South, Georgia is full of fantastic neighborhoods. Atlanta is one of the most economical and fastest moving in the state, so buying a home here is a smart move. However, when you consider areas like Forsyth where the market is at an all-time high, you may be worried about a nosedive in equity. Looking at past trends is helpful when committing for 30 years.

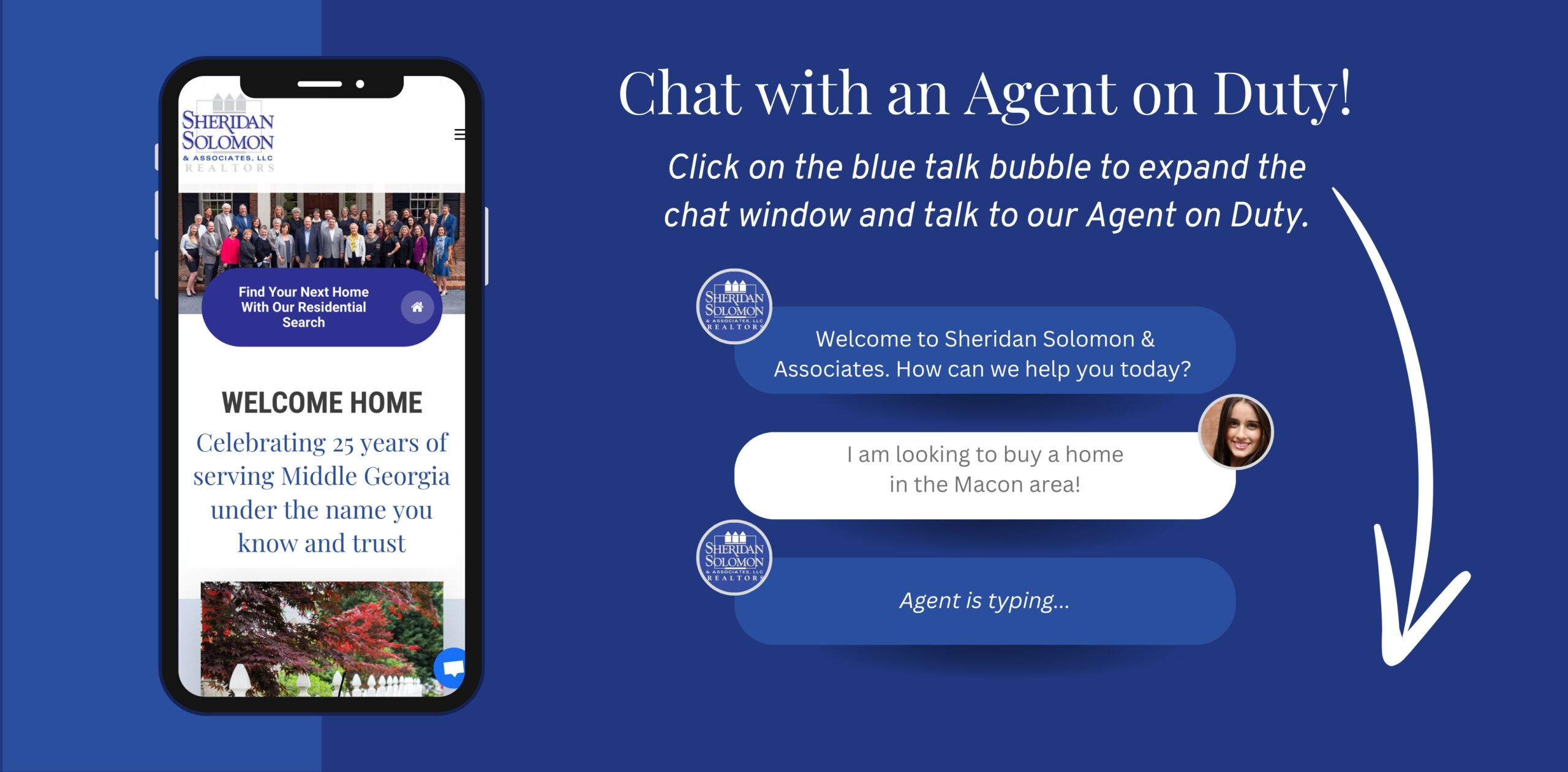

Additionally, when considering what market should I buy a home in vs. renting, it’s always best to talk to a realtor that knows the area well. They can tell you current trends as well as history in that locale. They know what neighborhoods will give you the best bang for your buck. Buying is a good option, but only if it fits your needs. The real estate experts at Sheridan Solomon and Associates are here to help answer any questions you may have and help you find what’s right for you.