The fees involved in a real estate transaction are abundant, and you may not be aware of all the costs you might incur throughout the process. Alongside every sale of real property, there is a list of expenses called closing costs. These costs include all the final expenses required to complete the transaction. They are typically calculated on a balance sheet and paid by the buyer and seller at closing.

It is important to understand these costs and prepare for them in your budget, because the full amount typically must be paid in cash. In this post, we will discuss possible closing costs for both buyers and sellers, how these costs will be applied, and how much you can expect to pay.

Buyer’s Closing Costs

As a buyer, careful budgeting is a critical first step in your real estate journey. To set expectations, buyers will usually pay 2-5% of the purchase price in closing costs alone. For example, if you are buying a house for $215,000, you can expect to pay between $4,300 and $10,750. This amount should be added to your down payment when calculating your total cash needed to close. Ideally, you will also have enough money leftover to serve as an emergency fund after closing.

Closing costs are comprised of fees that are owed to your lender, closing attorney or settlement agent, title company, government entities, and other service providers throughout the transaction. Let’s go over some of these items and how much they might cost.

Property Reports

Once you go under contract on a house, you will have the opportunity to order services such as a home inspection, wood infestation report, and survey. These are optional services that can cost between $700 and $1700 altogether, depending on the tests you choose. Keep in mind that some of these reports may be required by your lender, so be sure to find out which ones you need to order.

Lender Fees

When you apply for a loan, you can expect to pay several fees to your lending institution. Lenders typically charge fees for your loan origination, loan processing and underwriting, credit report, and flood certification. The cost of these fees often vary from one lender to another, but the biggest cost, your loan origination fee, will cost 1% of the loan amount on average. You may also choose to pay buy-down points to lower your interest rate, whereas each point costs 1% of your loan amount.

Altogether, these fees are added to your interest rate to calculate your annual percentage rate, or APR. If you shop and compare lenders before you begin your search, you are more likely to save money by choosing the one who is offering the lowest APR.

In addition, your lender will most likely require an appraisal, which may cost anywhere from $200-600.

At closing, you will also pay prepaid interest on your mortgage for all the remaining days in the month that you close. For example, if you close on January 10, then your mortgage will accrue interest from January 10 to January 31. Since your first mortgage payment will not be due until the first of March, your lender will charge you for those 21 days of interest ahead of time, on January 10.

Escrow Fees

If you obtain a mortgage, it is common for your lender to collect your property taxes and homeowner’s insurance each month with your mortgage payment. These payments will be placed in an escrow account on your behalf until they are due. To ensure there is enough money in escrow to cover these items, lenders will require you to pay a full year’s worth of property taxes and homeowner’s insurance on the day of closing. According to tax-rates.org, average property taxes in Macon County are 0.82% of the property’s assessed market value.

Settlement Fees

Closing preparation involves a lot of processing and background work, and the buyer and seller often split the costs for this, or negotiate them during the transaction. These might include attorney fees, title examination and underwriting, title insurance, and recording fees.

Typically, the buyer will pay for the lender’s title insurance, and the seller will pay for the owner’s title insurance, each of which is usually 0.1 to 0.3% of the sale price. Title work may be split between both parties, which can cost $100-$200. The buyer will also be responsible for the mortgage recording fee, while the seller will owe the deed recording fee.

Seller’s Closing Costs

In a real estate transaction, seller closing costs will usually be 6-10% of the purchase price. For example, if you are selling a house for $275,000, your closing costs could be $16,500 to $27,500. Let’s look at what these numbers entail.

Buyer Credits

During negotiations, you might decide to offer buyer incentives, or extra cash to help cover the buyer’s closing costs. For example, if you know about some costly repairs that your house needs, you might offer to pay part of the buyer’s closing costs to help the deal go through successfully. These incentives are not uncommon when buyer demand is low, or if your house is not selling as quickly as you would like. Whatever credit amount you agree upon will be subtracted from your total at closing.

Government Fees

When transferring property from one party to another, sellers must pay the deed recording fee, which is typically $25. In the state of Georgia, sellers also owe a transfer tax, which is equal to $1 per $1000, or 0.1% of the sale price.

Additionally, since property taxes are paid in arrears, sellers must pay the prorated tax amount for the portion of the year that they occupied the home, as a credit to the buyer. For example, if you closed the sale on June 30, you would pay the property taxes owed from January 1 to June 30.

Attorney Fees

As mentioned previously, both buyers and sellers must pay fees to the closing attorney or settlement agent, and these costs are often split between the parties. These may include owner’s title insurance, document preparation, title work, and a municipal lien search.

Other Fees

As a seller, you will be responsible for paying any remaining HOA dues, HOA transfer fees, and an HOA estoppel, which the title company will request as part of the title examination.

Additionally, when you hire a real estate agent to list your home on the market, your agent will perform a lot of background work such as marketing the home, scheduling appointments, assisting with negotiations, and representing you in the transaction. In exchange, you will be responsible for paying their commission. This commission is often split between the listing agent you hired and the agent who represents the buyer. A typical fee is 6% of the sale price, but this may be negotiated if necessary.

Lastly, your bottom line is not complete until you pay off your remaining mortgage balance and all other liens on your property.

Summary

To sum it up, closing costs cover a wide variety of fees and services provided during a real estate transaction. These fees affect both buyers and sellers, but the costs can be negotiated and shared between the two parties.

For sellers, closing costs can make a significant impact on their bottom line, or the amount of cash they take home from the sale. Similarly, buyers should prepare for closing costs in their purchase budget to ensure they have enough cash to close the sale.

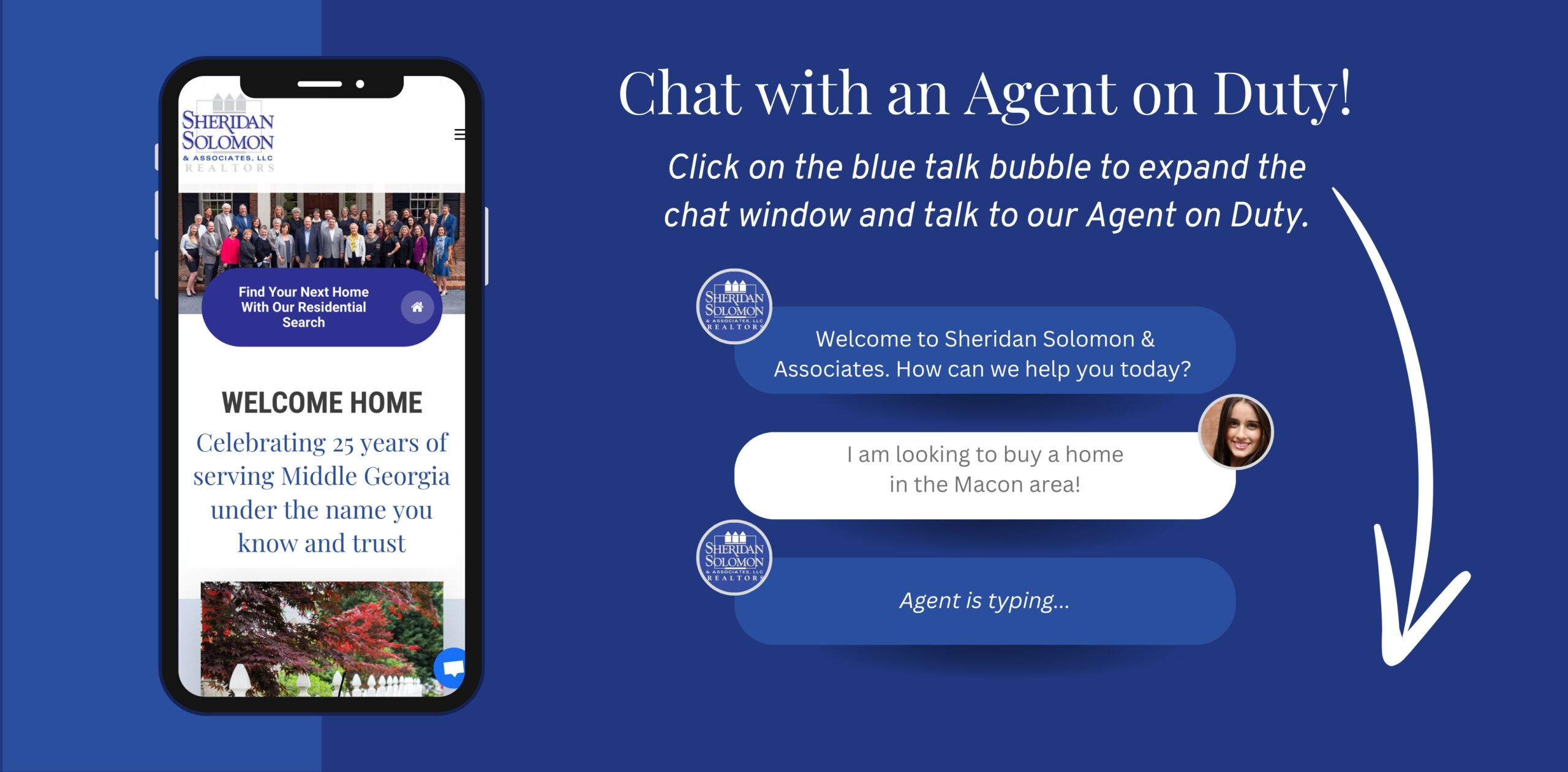

In order to fully understand your own closing costs, we encourage you to talk to a trusted real estate consultant. Our team of agents at Sheridan Solomon & Associates can answer your questions about about all the fees involved in your transaction and help you prepare for them. If you would like to learn more about closing costs when buying or selling in Middle Georgia, give us a call or reach out on our website today!

Macon: (478) 746-2000 | Warner Robins: (478) 333-2277